Tokenization of Assets: Future of Investment Industry

As the digital tide continues to sweep across the financial landscape, blockchain emerges as a potent force poised to reshape investment management. Its hallmarks—decentralization, transparency, and security—are the catalysts for such transformation. At the heart of this metamorphosis is tokenization, a process that digitizes assets, making them easily tradable on blockchain networks. Tokenization is not just a fleeting trend; it’s a doorway to a new era of investment possibilities.

Blockchain’s Edge in Investment Management

Unparalleled transparency is at the core of blockchain’s rising significance in investment management. Every transaction stored on the blockchain is accessible to all participants, embedding trust into the system and dramatically reducing fraud risks.

Further, automation through smart contracts is revolutionizing operations. These autonomous contracts, governed by preset rules, activate specific actions once certain conditions are met, minimizing intermediaries and thus, operational costs. This automation not only streamlines processes but also brings a layer of security, ensuring that transactions are executed as agreed upon without any alterations or unauthorized interventions.

Real-world impacts are also evident. Industry leaders like Nasdaq and Securities Exchanges are already leveraging blockchain for stock trading and settlements, harnessing its benefits of enhanced transparency, reduced operational costs, and improved security, propelling the investment management sector closer to an era of greater trust and efficiency.

Tokenization: A New Asset Frontier

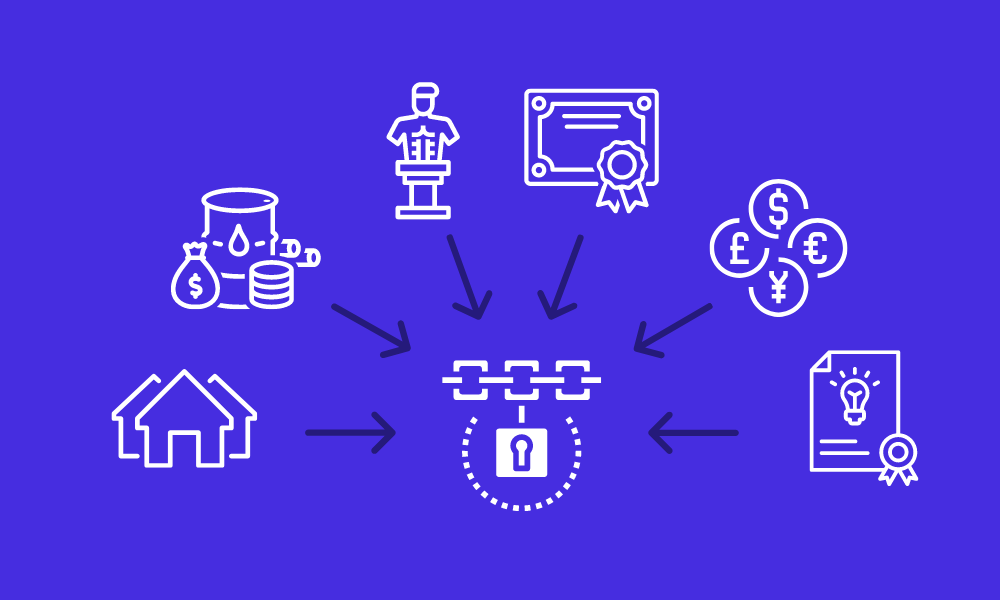

Rapid advancements are paving the way for robust blockchain infrastructures, broadening horizons for investors. One notable innovation is tokenization, a transformative process that not only converts the essence of real-world assets but digital assets as well into digital tokens on a blockchain. Whether it’s a piece of art, a house, or a digital item like a software license or a digital collectible, tokenization converts these assets into a digital form.

This process generates unique digital IDs or tokens for these assets, making it clear who owns them and simplifying the process of buying, selling, or trading them online. By expanding to digital assets, tokenization is further blurring the lines between the physical and digital realms, opening up a wide pallete of opportunities for investors and creators alike, in a secure and transparent digital ecosystem.

Unlocking Liquidity and Efficiency in Investment Funds

By converting rights to an asset into a digital token on a blockchain, tokenization facilitates the digitization of assets, allowing investment funds to overcome traditional hurdles like illiquidity, high entry barriers, and clumsy manual processes Traditionally illiquid assets become easily transferable and divisible, which not only broadens the investor base but also accelerates the settlement process.

Furthermore, the transparency inherent in blockchain technology introduces a new level of transparency and trust among investors. Every transaction is recorded on a public or permissioned ledger, making the fund operations more transparent and verifiable. This transparency extends to regulatory compliance as well, where the immutable nature of blockchain assists in compliance and auditing processes, thereby reducing the associated costs and complexities.

Operational efficiencies are another hallmark of tokenization. By automating many of the manual processes and reconciliations through smart contracts and distributed ledger technology (DLT), tokenization expedites transactions, reduces errors, and significantly cuts down operational costs. This reduction in costs not only enhances the efficiency of investment services but also leads to cheaper investment options for end-users. Cheaper investment services, in turn, translate into higher potential income for investors, as lower fees and costs mean more of the investment gains are retained by the investors themselves. Moreover, the data integrity ensured by DLT allows for real-time sharing of identical data sets across various stakeholders, further contributing to streamlined operations and informed decision-making. These advancements collectively lead to a more affordable and accessible investment landscape, thereby democratizing investment opportunities and potentially increasing returns for investors.

The Path Forward for Blockchain in Investment Management

In a rapidly evolving financial landscape, the adoption of tokenization by investment funds is a forward leap towards a more agile, transparent, and inclusive investment ecosystem. For those poised to integrate blockchain and tokenization into their investment strategies, thorough research and expert advice are crucial. This technology is not just a trend; it’s weaving a new narrative in the investment realm. Stay informed and seize the opportunity to diversify, enhancing transparency, reducing costs, and broadening your asset portfolio in a secure ecosystem. Don’t just watch the blockchain revolution; be an active part of it.

Eager to learn more? Contact us for expert insights and guidance.